Part 3b. Leasing

In investigating the cost of leasing a Nissan Leaf, I wondered, how are friends of a friend affording this?

Dave Ramsey refers to leasing as “fleecing”, why?

I really didn’t understand until I did this investigation as if I would truly lease one.

Here are the terms in the fine print and from speaking to a dealer:

*you must lease the car through Nissan Motor Acceptance Corporation for at least 36 months.

*$595 buys you someone “processing” the lease for you. (Will you clean my condo also?)

*$1999 of your money goes towards reducing the starting car cost called “capitalized cost”. It’s so that they can get close to the advertised price to make you happy.

$199/mo payments are advertised, but it has an asterisk meaning that perhaps you can get there with the best rate. What is the payment for our avg. Example. “non prime” (below 650)?

It’s little trickier to figure because this is a lease, not debt, so it skirts the “truth-in-lending laws”. It is NOT included in the contract, and can hoodwink you.

Modified from Lord of the Rings. New Line Cinema 2003.

They include in their calculation something called the “money factor”.

It’s kind of a sneaky way of determining your interest on lease payments without being in the contract…A way to get you to pay for excessive depreciation on a car so that they don’t have to. I’ll explain it the way I understand it, without trapezoids and things.

Here’s a Nissan money factor table from 2010:

Notice tier 3-.00369

Seems like a small number…

The only way to find out this number is to ask the dealer. It is NOT in the contract.

To get the APR, multiply this money factor by 2400.

Always 2400.

Why? Because there are people more in love with trapezoids than yours truly:

I cannot even look, but you go right ahead:

Basically, it’s a way for a bank to make money off you given that a car is an asset that loses value over time.

Tier 3 is .00369

.00369*2400=8.9%

You are borrowing lease $ at almost 9%!

Even if you have great credit, you are borrowing lease money at 4.9%!

That’s insane!

And I’m not just picking on Nissan here-this seems to be how car “fleecing” works.

I’m as dumbfounded as you.

It gets worse.

What am I paying interest on?!

Let’s go back to the car I “built” from the Nissan website:

Cost of the car $33,477

Minus

-Our $1999 ($2000)

-$9425 assumed credit from dealer

$22,052

Plus that $595

$22,647

This is the starting or “capitalized cost”

What they want you to finance is the difference between this $22,647 and the “fair” (lowest) condition kelly-blue-book jalopy wholesale value of the car in 3 years. This lowball trade-in value is called the “residual” and it hovers around 37-44% of the original MSRP, which is not super given that Carmax retail is around 50% of the original value. Honda Civics hold their value because they are well-tested and reliable. If you bought one for $20,000 today it might still be worth $15-18,000 in 3 years at Carmax. Not so for the Leaf-a paltry 37-44%? What a crock!

Let’s check kbb.com to see what the dealer is assigning to your “residual”. Excellent or Good condition? Not even close, “fair” is a nice way to say “bad”

$11,000

3 year old Leafs retail at Carmax for about $17,000. This is not what is offered to you in a lease.

Having you finance the difference of $22,647and $17,000 won’t make them much money (only financing $5,000), so they increase the gap to be wider ($11,000). That way, you finance about $11,000 instead of $5,000.

$1575 vs. $716

Those rats!

Yes.

Nasty, right?

Where were we mathwise?

Capitalized cost:

$22,647

Residual:

$11,000

The gap:

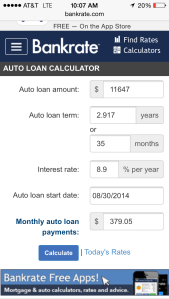

$22,647-11,000=

$11,647

Amount to finance at

8.9% for 35 mo (your down payment counts as month one).

Your monthly payment is $379.05, not $199.

Can we get there with good credit, financing $11,647 @ 4.9?

Nope.

Our payment is still $357.79

How on earth do we get there? Extend the months?

Ah ha!

A 6 year lease term?

Seriously?

You’ll have “payments” for so long, they will feel like a pet.

And at the end, you will have paid:

$2,000

$13,267

$395 disposition fee.

$500 wear and tear

$300 for battery insurance

$480 EVgo 1 year membership